Miles Williams Mathis: U.S Tax Income

By Miles Williams Mathis on April 16, 2025

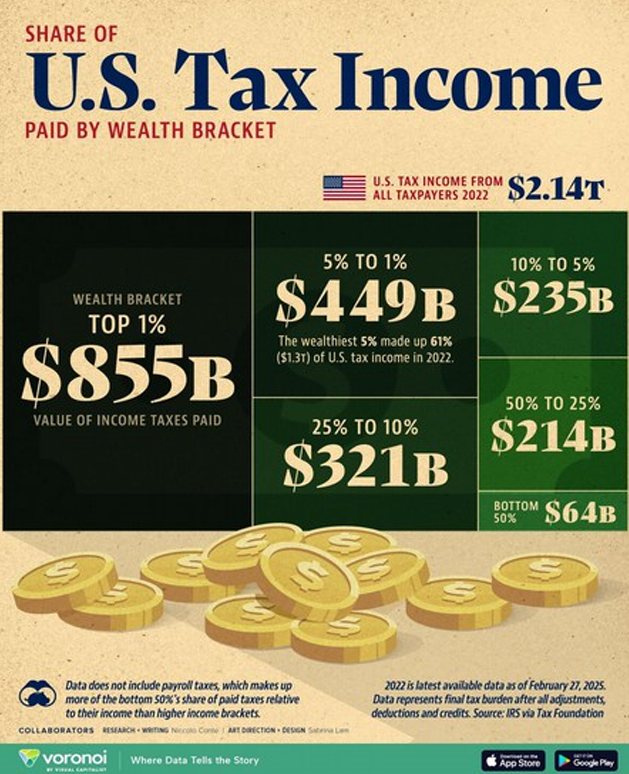

I found that chart today at Zerohedge.

How Much Does Each US Wealth Bracket Pay In Income Taxes? | ZeroHedge

I will use it as a lead-in to discuss taxation and income disparity, but first we should ask, is it true?

No, it comes from the Tax Foundation, which was started in 1937 by very rich people from:

- General Motors

- Standard Oil

- Johns-Manville

so, it isn’t trustworthy at all.

Who Pays Federal Income Taxes? Latest Federal Income Tax Data

These people have been lying to us about everything so why believe this?

The article was written and published by rich people to make us think they are already paying their fair share, or way more than their fair share, but given that income disparity has been on a steep climb since Reagan, when the tax structure was flattened, going into overdrive in the 2000s, it simply cannot be true.

And to the small extent it is true, it is still a tragedy because it is proof these people now have all the income.

They have raked almost all the chips into their pile since 1980, so of course they are going to have a larger percentage of income, and therefore federal income taxes.

The taxable income of the bottom 50% is now so small we could just jettison that piece of the pie altogether, dropping our taxes to zero, and it wouldn’t make much difference.

We pay about 3% of total taxes according to that chart, which the rich point to as proof we aren’t paying enough or are freeloading on them.

But that isn’t what the chart is telling us. It is telling us the rich have already pillaged us to such an extent we have nothing left to steal.

I’ll do the math for you, as usual.

That chart tells us the top 1% have 13 times more taxable income than the whole bottom half of US society put together.

Which means they have 668 times more taxable income on average than you do, if you are in the bottom half.

So, they aren’t just twice as rich, or four times as rich, they are 668 times as rich, which gives you a rough idea of the income inequality in the US.

How much is that?

Well, if you went and stood beside the Trump tower in Chicago, the height of the tower would represent how much more income these people have than you.

That’s how much bigger they are than you in this society.

That chart also doesn’t tell you what you can learn by digging just a bit at Tax Foundation by taking that last link:

the top 1% is now paying only about 23% of their income.

You hear a lot about the top bracket being 90% back in the 1950s or 40% now, but that is just misdirection.

The effective rate for the very rich is now lower than it has ever been, and it is about to go lower with Trump.

That’s the main reason the IRS pretty much quit auditing the lower half:

it isn’t cost effective.

They used to audit a certain percentage of all returns, and they wanted you to think it was random to scare you into compliance.

Though of course it never was.

But several decades ago, they dropped audits way down, targeting them to richer people.

You can see why.

Most people are now so poor in real terms they couldn’t pay the IRS anything even if found in default:

they simply haven’t got it.

Yes, the IRS can garnish wages, but only if you have a steady and trackable job and are paid by a solvent employer, which many people don’t and aren’t.

Rather than have the IRS garnish their wages, they quit and start working for cash.

I know all this because my parents were CPAs, and because I have been living among the cash people for decades.

And I draw your attention to the fact that it isn’t the bottom 10% or 25%, it is half the country that is now too poor to tax.

Half the country is now in the lowest bracket, functionally destitute as a matter of income taxation.

But it doesn’t matter, because we are still being raped by regressive sales taxes, property taxes, other fees and licenses, price gouging, fake shortages, and inflation.

We are actually being milked like never before.

So, you begin to see why I still call myself a liberal, even now.

Not Neo Faux Left, since I am not pushing trannies or DEI or any of that mess, but a liberal in the sense of thinking this sort of income disparity is criminal.

The fat cats have been spending billions per year in propaganda to make you think anyone against this state of affairs is a raging Communist who wants everyone living in two-room apartment rises and eating bugs, but that is never what liberalism was about.

[That is what the fascist group Tax Foundation is about, you know: fooling you into think they are the good guys by fudging and misreading statistics.]

In fact, the old definitions of liberal and conservative were far more useful and telling, which is why the plutocrats buried them and eventually flipped them.

Conservative meant you wanted to conserve the current state of things, which is why rich people were conservative.

They wanted to keep this state of things where they were strolling through society like 400m buildings while you were crawling around in the dirt, begging for scraps.

Liberal meant you were against that.

It meant you didn’t believe some asshole who had found a way to corner the market in oil wells through payoffs and other skullduggery was 1000 times better or more important than you.

It means you didn’t believe he should be able to pay off Congress and the President to run the country the way he wanted.

That’s what liberal originally meant, before the Rockefellers and others mangled it.

It has nothing to do with Communism, since liberalism predated Marx himself.

Miles Williams Mathis: Reading the Signs – Today’s Lesson: Karl Marx – Library of Rickandria

The Founding Fathers were liberal, remember, or at least pretended to be.

They were against the King and his cronies running everything and taking all profits.

They wanted citizens to be protected from pillage and to have a voice, which is why they wrote a Constitution.

The Constitution is a liberal document.

Which is precisely why the rich and conservative Bushes called it:

“just a goddamned piece of paper.”

Miles Williams Mathis: LOOKS LIKE the Bushes are Jewish – Library of Rickandria

But let us return to the chart.

If we add the two lowest pies, making up 75% of the country, we find them with only 7.7% of the income.

That’s just horrible.

But it is actually far worse than that, since we are only looking at income, and much of the wealth of the rich isn’t income.

It is CAPITAL.

Say you are a Rockefeller who inherited $10 billion, but you decide to turn it into gold or silver or diamonds and store it.

It isn’t invested so it isn’t creating any income.

Well, your taxes on that are zero.

A lot of other things rich people own also aren’t taxable, either because they aren’t income, are hidden, or exist in various other loopholes.

Another way to say that is that income tax only applies to new wealth generated in various ways but doesn’t apply to old wealth (until it is sold and generates new profit).

So a large part of the wealth of the very wealthy doesn’t make these charts.

Which means we can add at least another factor of a hundred to our income disparity, giving the lower 75% a 99.9% loss.

Or, to say it another way, you would be 1000 times richer in a classless society.

In a recent paper, I suggested everyone in Norway should be millionaires, due to their oil reserves, but that is true pretty much everywhere in the first world.

The rich always answer they create more value, so they deserve to be rich, but that is just another lie.

We can look at the military as just the easiest example.

Notice the chart tells us $2.14 trillion was collected in federal taxes in 2022, and Trump just asked for $1 trillion for defense this year.

So almost half the budget is for “defense”.

Defense from what, we aren’t told, since China and Russia spend about 1/10th that much on defense.

But it gets worse, since that doesn’t include all the Intel agencies, who take another 200-300 billion.

So at least 60% of the budget is for that.

We are getting no value there, since most of that is vapor.

It is for stuff they either aren’t delivering at all, are delivering to store and rot, or are overcharging us 1000% for.

Or, in the case of Intel, it is being used to spy on us and gaslight us 24/7 with fake news and history.

Negative value.

But this is how the rich are getting rich.

They either run these defense, security, and intelligence companies or invest in them.

The other big source of income for the rich is banking, via which they drain the treasuries of the world year by year but tag it as “interest”.

They basically steal our money then loan it back to us at high interest.

They then use the proceeds to gamble in the various markets, making many more billions when they win and letting us take their losses.

Anytime they lose they bail themselves out from treasury.

So again, no value there for us except negative value.

Also, nothing from Trump about bringing back regulation or reinstalling Glass-Steagall or outlawing bailouts or outlawing derivatives or hedge funds or cloaked investment groups or otherwise protecting people from predatory banking.

Same if we look at something like minerals or oil.

Ownership of that should be public, but it isn’t.

These rich bastards buy mineral rights from the government for next to nothing, make billions on gold or copper or oil or gas or coal, and pay nothing back to the treasury.

Same with timber and now water rights, which the rich make billions from.

Ask yourself why these people should be making all the money on these resources.

Did they make the oil, minerals, timber, or water?

No, they just take the profit.

That isn’t adding value, it is raping the Earth and not even giving you a cut of the profit.

I will be told these people create a lot of jobs, since the bigger the companies are the more people that they hire.

Except that, again, that is mostly a myth, and the myth is getting bigger by the day.

Supposing these companies are doing something that needs to be done and not just creating plastic garbage or something, even in that case the very rich soak up all the profits because the lion’s share of the money doesn’t go to employees, it goes to top executives and rich investors.

Is there any reason a CEO needs to be making $10 million a year, or $100 million a year, or a billion a year?

No, and there is no reason for rich investors to be making huge profits either, since they aren’t doing squat.

All that money is just siphoned and should be marked stolen in any honest society.

And as robots and AI take more jobs, fewer and fewer real people will benefit from any company’s success.

Millions of people have been jettisoned from the workforce and millions more are about to be, for no good reason.

Simply to make the filthy rich filthier.

This will just make the current problems far worse. In the last election Trump tried to sell himself as a populist, promising to reverse many of the worst trends of the past decades, but that was just another smokescreen, since—except for a few small things like DEI or trannies—he has no intention of reversing anything.

He lowered taxes for the rich in his first term and is going to do it again—the exact opposite of populist.

He just asked for the largest defense budget in history, and not by just a fraction.

He requested a defense budget larger than any before.

This to cover Golden Domes, fake wars in the Middle East, more billion-dollar bombers we don’t need, and various other boondoggles to further enrich his pals.

1/3rd And where is that money going to come from?

Well, it mostly won’t come from you and me, since we don’t have anything.

We were robbed down to bare ground years ago.

And it won’t come from a middle class, since we have seen from the chart there is no middle class:

75% of the country is all but untaxable.

Most of it has to come from the top 10%, so, as I have said before, we now have class warfare between the rich and the superrich.

There is no one left for the superrich to plunder but the rich.

The top 1% will attack the next 9%, not via taxation but via corporate warfare:

bigger fish, eating smaller fish.

And the same thing will happen in the federal government, where smaller departments will be swallowed by larger ones.

As in the Department of Education being swallowed by Defense.

I am not sorry to see the current Department of Education go, but it should have been gutted and rebuilt on logical grounds, not discontinued.

Same thing I said about the NEA, National Endowment for the Arts, years ago.

Having been taken over by the Moderns, it needed to be burned to the ground; but rebuilt, not buried forever.

- Art

- Science

- Education

all need to be rebuilt from the foundations, with money being taken from Defense and Intel to rebuild them.

Not the reverse.

I don’t agree that any of this needs to return to the States, since the States have no plans that I have ever seen to rebuild art, science, or education.

For the most part the States are just as moribund regarding all three as the Feds, for the same reason.

Other than try to turn art and science into DEI realms, what are any States doing to promote them?

Absolutely nothing.

States don’t have taxes earmarked for these things, and so they argue it is the responsibility of counties or cities . . . and then the cities also beg off for the same reasons.

They have to spend all their proceeds on police and jails and roads and hospitals.

So, nothing ever gets done. Just as the superrich want it.

They don’t care about real:

- art

- science

- education

since those things can’t be easily monetized.

Those people aren’t interested in anything that can’t be mangled to generate a quick dishonest buck.

Actually, money does end up getting spent on these things, but it doesn’t come from States or counties or cities, it comes from the big Foundations and other NGOs.

When these things are:

“sent down to the local level”

it doesn’t mean they are being sent down to the local level, it means they are being freed up for further cooption and infiltration by evil entities like the Rockefeller Foundation, the Gates Foundation, the Soros Foundation, the Aspen Institute, and of course the CIA.

NWO: GLOBAL INTELLIGENCE: CIA: Central Intelligence Agency – Library of Rickandria

In other words, fronts for the superrich again.

At least at the Federal level these things have some pretend oversight—or used to—from Congress, the GAO, and various other agencies and watchdogs.

But once they are sent down, all that evaporates, and these private entities posing as Foundations or Philanthropies are free to infiltrate them with no oversight.

The same thing is true at the university level, as we have seen many examples of recently.

And when these Foundations spend money on art, science, or education, it isn’t to advance them, it is to further bastardize them and turn them to crud.

But I guess the investment is worth it to them, since a people that have been propagandized by:

- education

- art

- science

rather than enriched by them, are incapable of rational thought or action.

They cannot resist, say no, or revolt.

All they can do is lurch around like zombies, carrying signs that say:

“science is real, love is love”

and things like that.

Women’s rights are human rights. . . except of course when women want the right to pee alone or race against other women.

Which reminds us that taxation was never the right way to deal with any of this.

The name Rockefeller should have told us that.

That is where you could trace back almost all Modern failures.

Others had gamed the system before Rockefeller, but he took it to a whole new level, putting both US Capitalism and Republicanism to the ultimate test, which they failed miserably.

The new taxation was created back then to try to re-distribute some of the wealth these people had gathered to themselves, i.e. stolen, but it was hopeless from the first day.

It just encouraged Rockefeller and others to develop these other feints like Foundations and Charities and Philanthropies, and when people like Roosevelt pushed back on that as well, it led to the CIA.

You can’t fight back against that with higher income taxes, obviously.

A real Republic would have outlawed these Foundations from the start, shuttering them by force, but that never happened and probably never will.

A President who really wished to turn the tide would start there, shuttering all:

- Foundations

- NGOs

- thinktanks

and Congress would back him up immediately, but there is no chance of that happening.

He would also ban all lobbying of Congress.

He would ban corporate funding of candidates, or rich people funding candidates, or links between corporations and the government, and so on.

He would dissolve the Federal Reserve and nationalize the treasury.

He would dissolve the CIA and other intel agencies as tools of the billionaires.

But since the President is another such tool, that will also never happen.

But I point this out as the real problem and solution.

All talk of taxation or Capitalism v. Socialism is just more misdirection, since what we have is not Capitalism, it is legalized plunder by the rich and corporate welfare.

And what we see coming from the Neo Faux Left isn’t Socialism, it is late-stage corruption and planned societal dissolution.

You can’t tax or spend yourself out of that, no matter what you do.

The only hope is to pass laws against corporate racketeering and all other malfeasance and enforce them harshly and consistently.

But since the rich own Congress, that ain’t gonna happen.

It now looks like the rich are hell-bent on burning out in some Sodom and Gomorrah type conflagration of their own making, and it is doubtful anyone can do anything about it, but more distressing to me than that is watching them drag relatively innocent normal people down with them.

I will be told the Lord will save the righteous, but can you remain righteous while cheering the billionaire frauds or believing their obvious lies?

Can you remain righteous while investing with them?

Can you remain righteous while taking their thirty pieces of silver or repeating their stories?